How a Bank Works and Fails, Visualized

Part 1. How a Bank Actually Works

I usually animate explanations of complex financial concepts (you can see some here). I love making them, but they take some time to create.

As you probably heard, Silicon Valley Bank recently failed and triggered worry of a banking crisis. Several folks have asked for a visual explanation of what happened, and I’d been sketching to make sense of it myself.

So, I’m going to experiment and try sketching here to get something out faster. I hope it helps and please let me know what you think!

OK. Before getting into all the complicated stuff, I’ve noticed there is fundamental question most people are afraid to ask:

“How does a bank work in the first place?”

So, let’s start there.

How a Bank Works

A few people get together to start a bank. They put some money into it. This is the bank’s capital.

Then they attract some customers who deposit money. This keeps their money safe, and they can conveniently get it when they want so they don’t have to carry it around all the time. But, you should also think of this as a loan to the bank.

In exchange for your money, the bank will pay you a small fee, called an interest rate.

Deposits are liabilities for the bank that, at some point in the future, must be repaid.

But, until customers withdraw the funds, the bank is going to use that money! It makes loans and investments at a higher interest rate than it pays customers on their deposits.

Most banks lend to people, businesses, and the government.

Loans are assets to the bank. They have lots of different names, like mortgages, commercial paper, or bonds — but they are all essentially loans.

So, now the bank has borrowed money at a low interest rate and lent it back out at a higher interest rate. This is called the spread, and along with charging fees, it’s the main way banks make money.

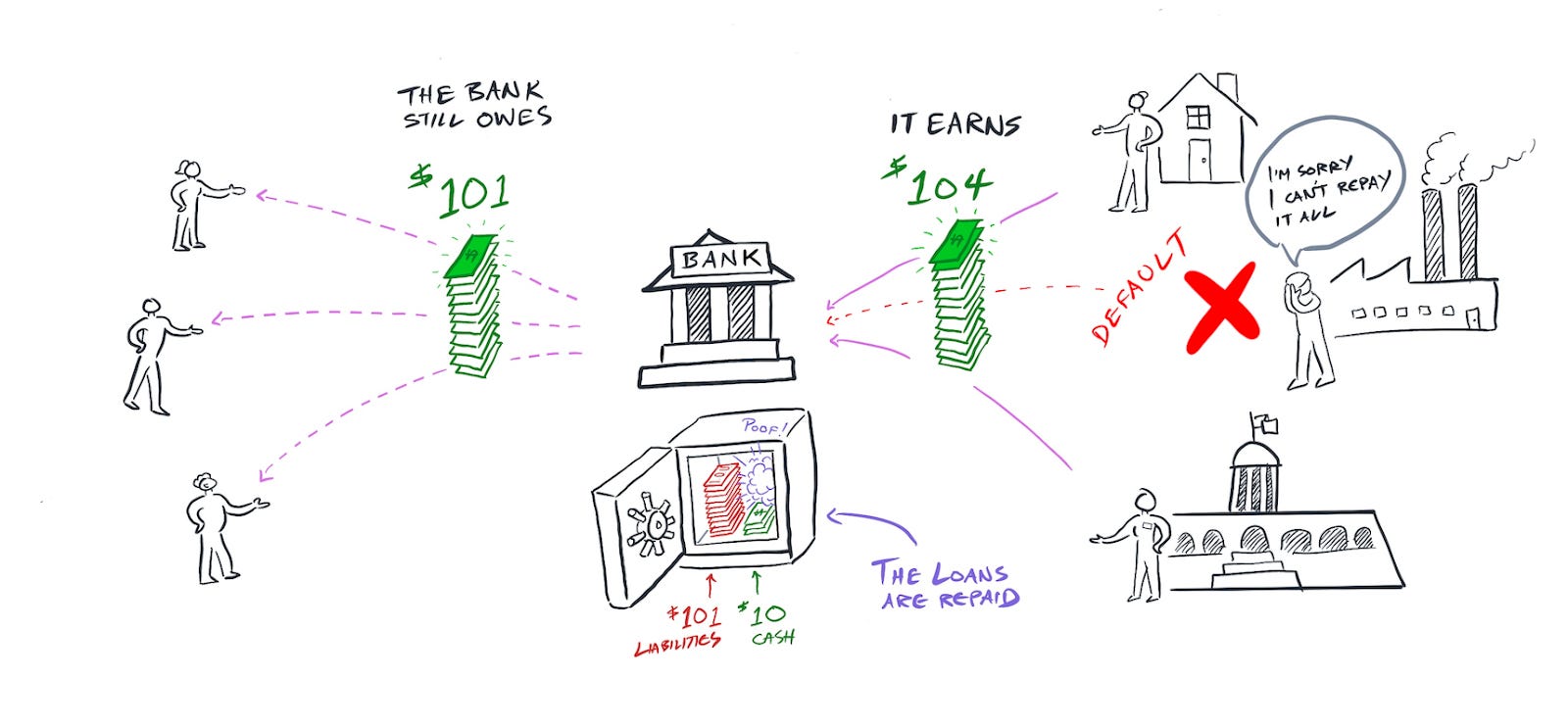

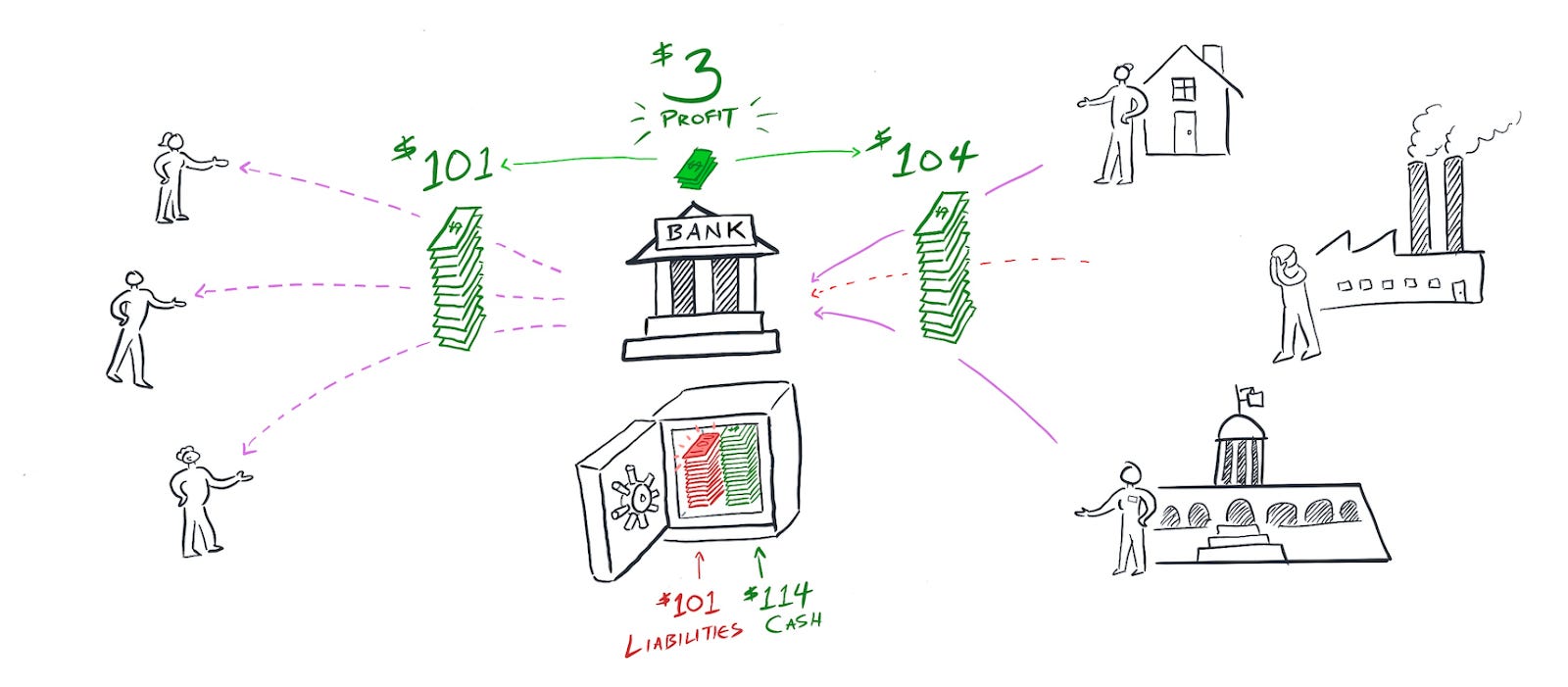

When the borrowers repay, the bank will earn income.

Of course, not every loan the bank makes gets repaid, so let’s account for some loss there. And the bank has expenses, like paying salaries, security, and such, so let’s account for that too.

Even still, it makes a profit.

It then makes new loans and investments.

It uses its profit to grow its capital reserves, or gives it to the owners of the bank who hold shares of stock by paying a dividend.

In this example a $1 dividend might seem small, but as a percentage of the original $10 investment that’s a 10% return to the shareholders. Not too shabby!

Now, banks don’t usually make all their loans at once and get repaid all at once. They plan them to be staggered so that everyday the income from their loans and investments meets the needs of customer withdrawals — while always keeping a healthy additional buffer of cash.

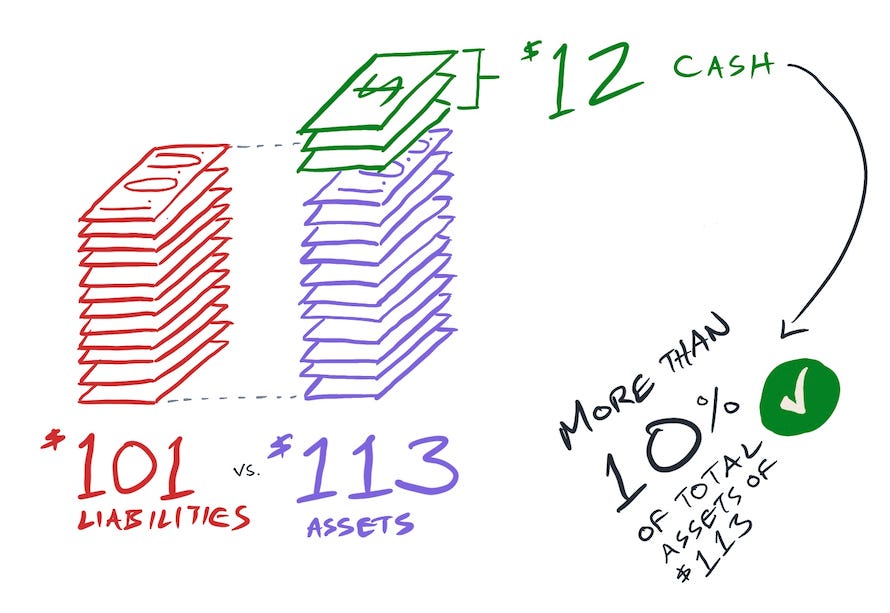

Banks keep a buffer in case their loans and investments start defaulting more or missing more payments than expected, or there is a surge in withdrawals or drop in deposits. This gives them time to adjust.

They are also required to do so by their government. While the amount a bank needs to keep handy varies based on its size and the types of loans it makes, for our example we’ll say it’s aiming for a cash buffer of at least 10% of its total assets.

If enough money is withdrawn that the bank’s buffer gets too low, it needs to get money to rebalance.

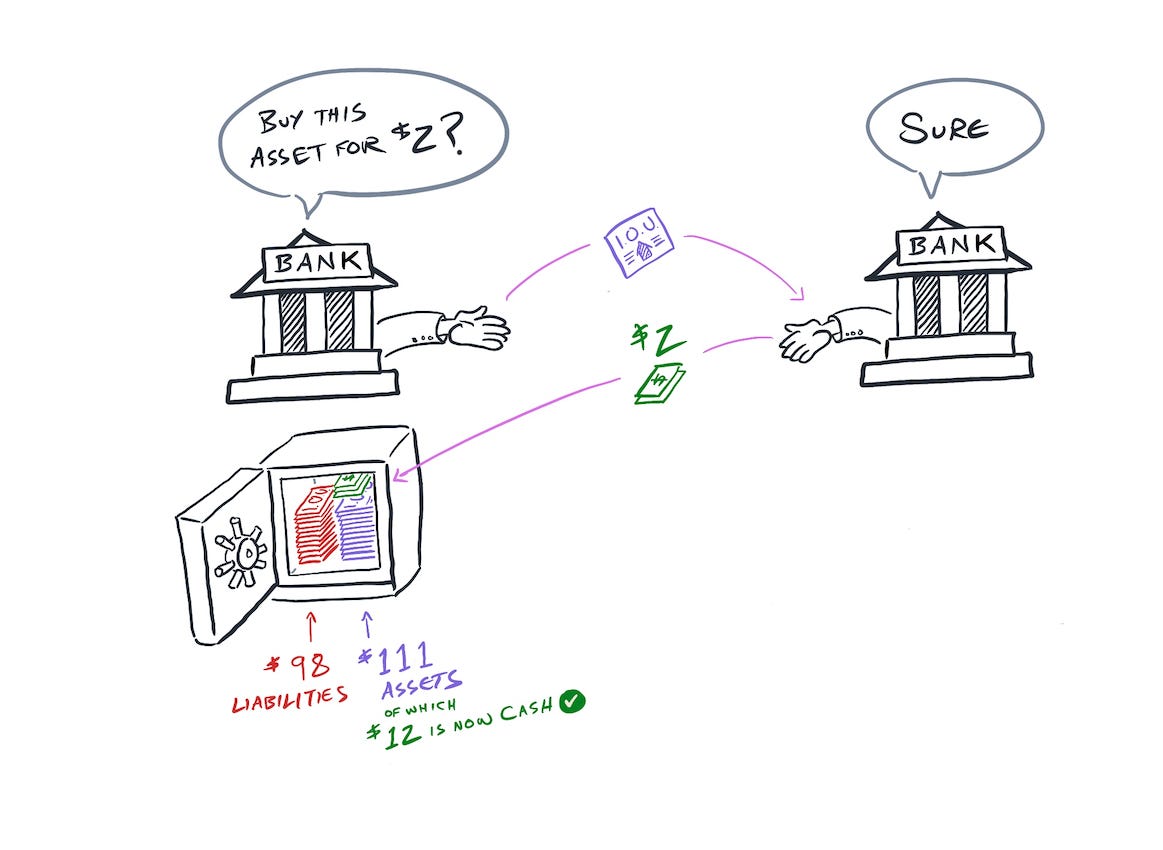

One of the ways it does this is by selling assets. It then uses the cash to rebalance its cash buffer.

Or, it could borrow money instead, using an asset as collateral. It might do this if it can borrow for less than it thinks it will earn from the asset.

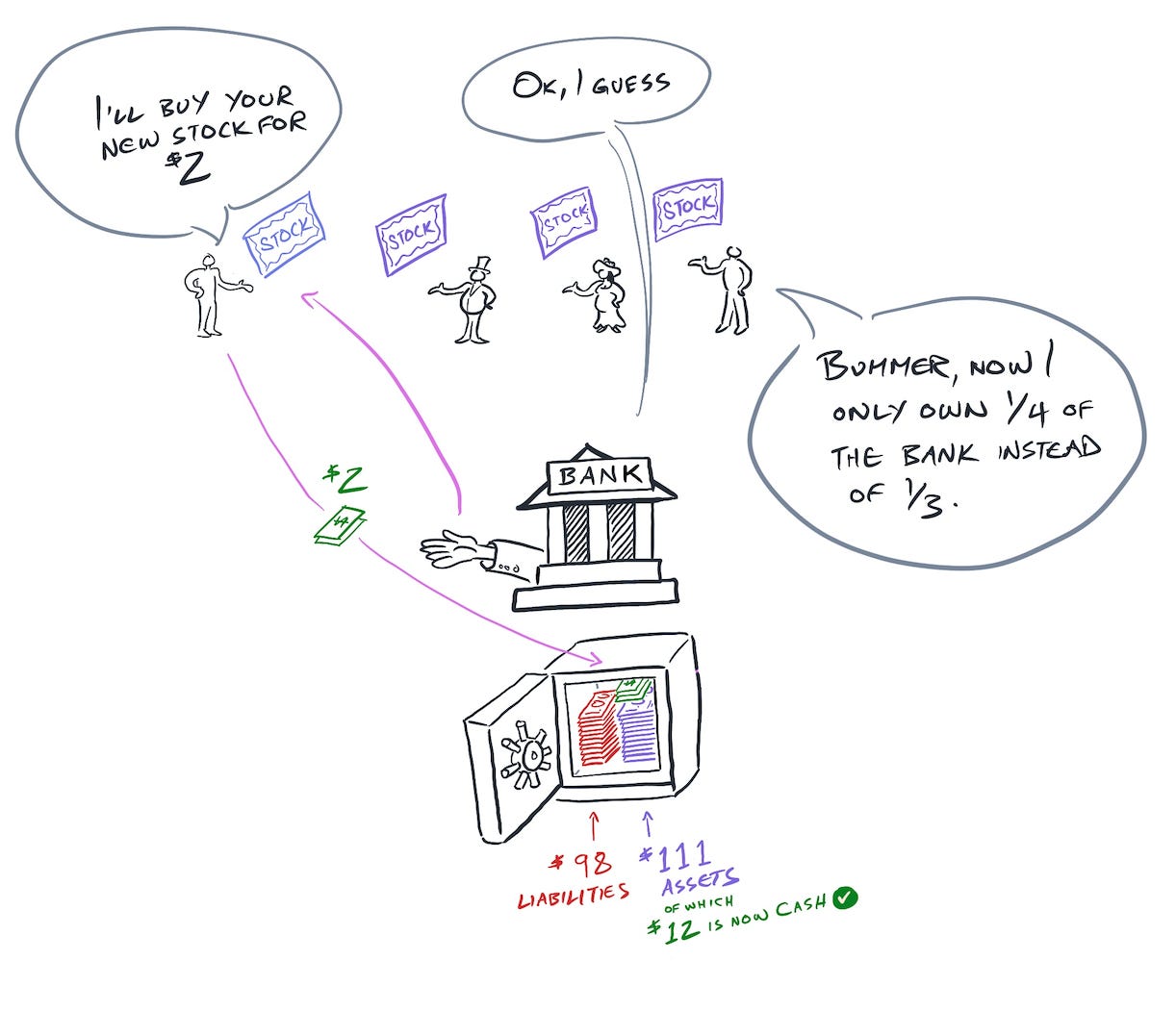

And finally, the bank could raise capital by creating and selling new shares of stock. This is usually done as a last resort, as it dilutes the existing shareholders by reducing the amount of the bank they own.

In all these scenarios, the bank rebalances and continues with business.

And that, more or less, is how a bank works!

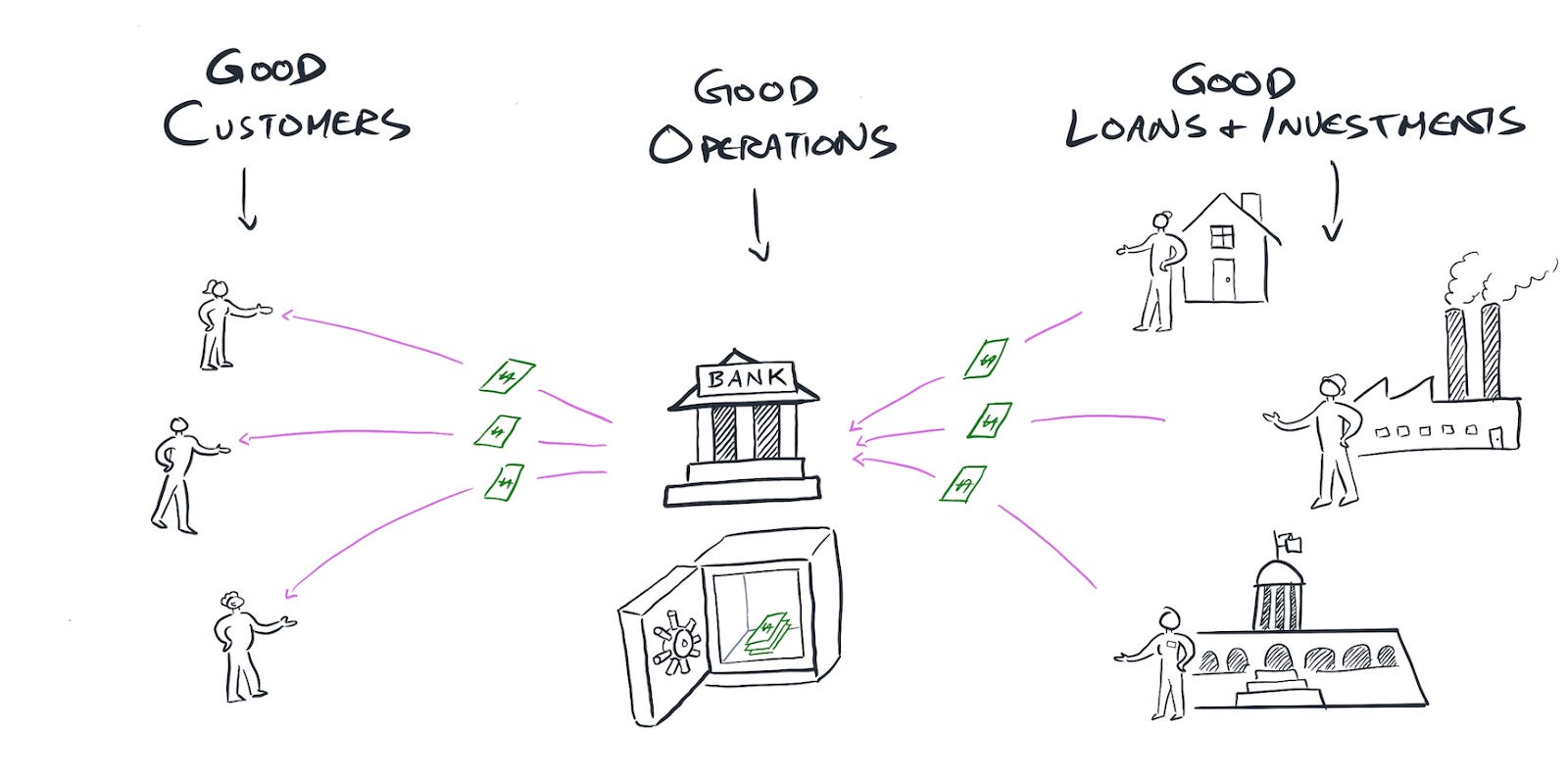

As long as the bank attracts and keeps good customers, runs its operations well, and makes good loans and investments, it works well.

But, sometimes it doesn’t work.

So, next time we’ll see how that happens — and how it happened to SVB.

You can subscribe if you want to see it when it’s out!

If you’ve had no interest in banking until now, you are not a loan. 🤣

I love your sketch figures and stick figures from your wedding invitations especially the one with red hair (Heather)!

"As long as the bank attracts and keeps good customers, runs its operations well, and makes good loans and investments, it works well." for a while until fractional reserve banking creates so much monetary debasement, malinvestment, and consumerism that the whole system implodes ;)

Looking forward to part 2!