How a Bank Fails, Visualized

Part 2. How a Bank Actually Fails

In my last article we covered how a bank fundamentally works.

But, banks don’t always work. They fail, just like any other business. But, unlike any other business, a failed bank can cause other banks to fail.

How?

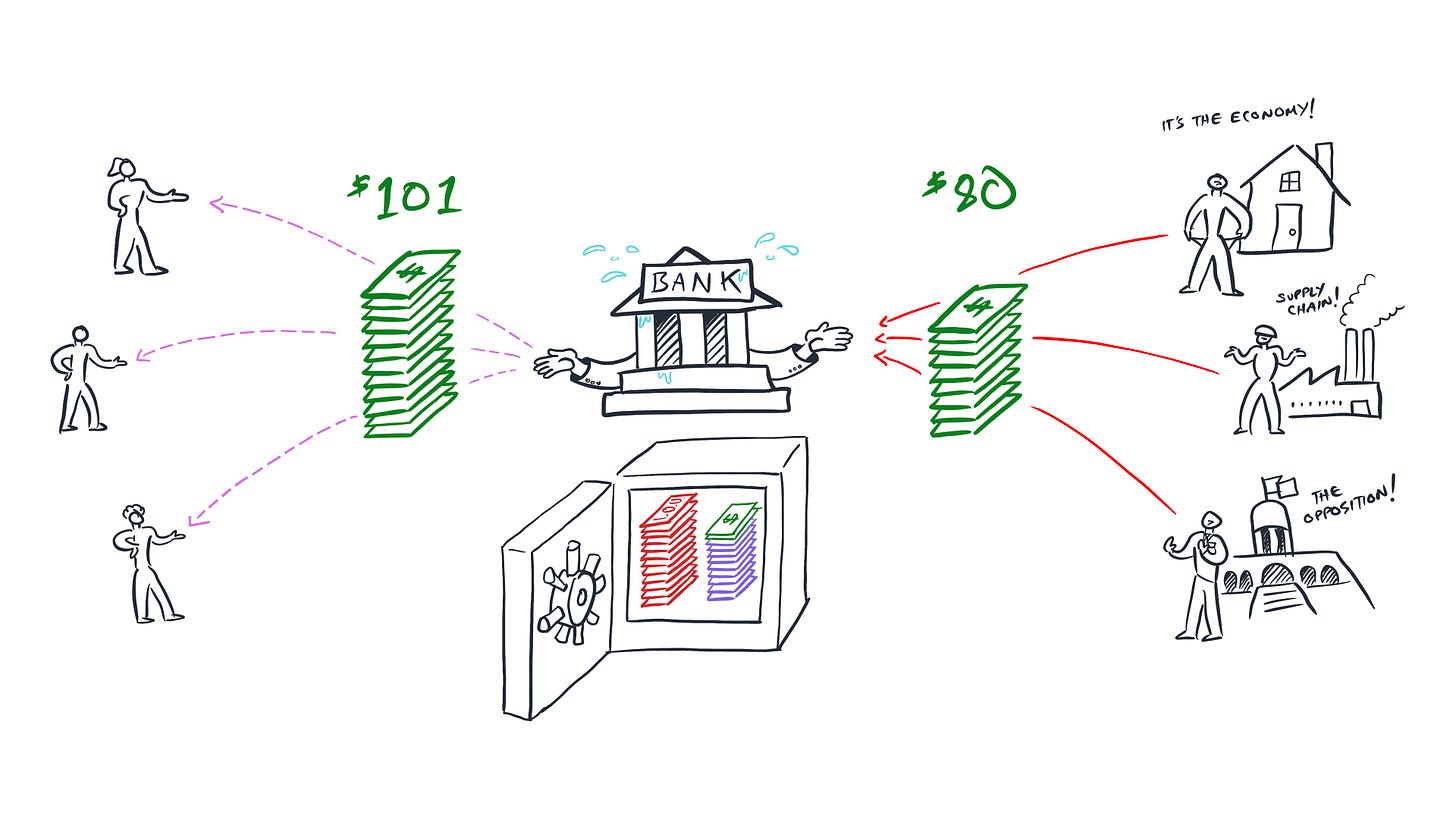

While a bank can fail from poor operations — like getting caught up in fraud — most banks fail because their loans and investments are too risky and they start to run out of money.

For a bank it’s called becoming insolvent. It simply means the bank can’t pay the debts it owes.

This happens when its assets are worth less than its liabilities.

Meaning, the bank doesn’t have enough money to give back to all of their depositors.

When depositors fear this might happen, they lose confidence in the bank and rush to get their money back before it’s gone.

This is a run on the bank!

The bank could sell all its assets, or borrow against them, but it wouldn’t be enough.

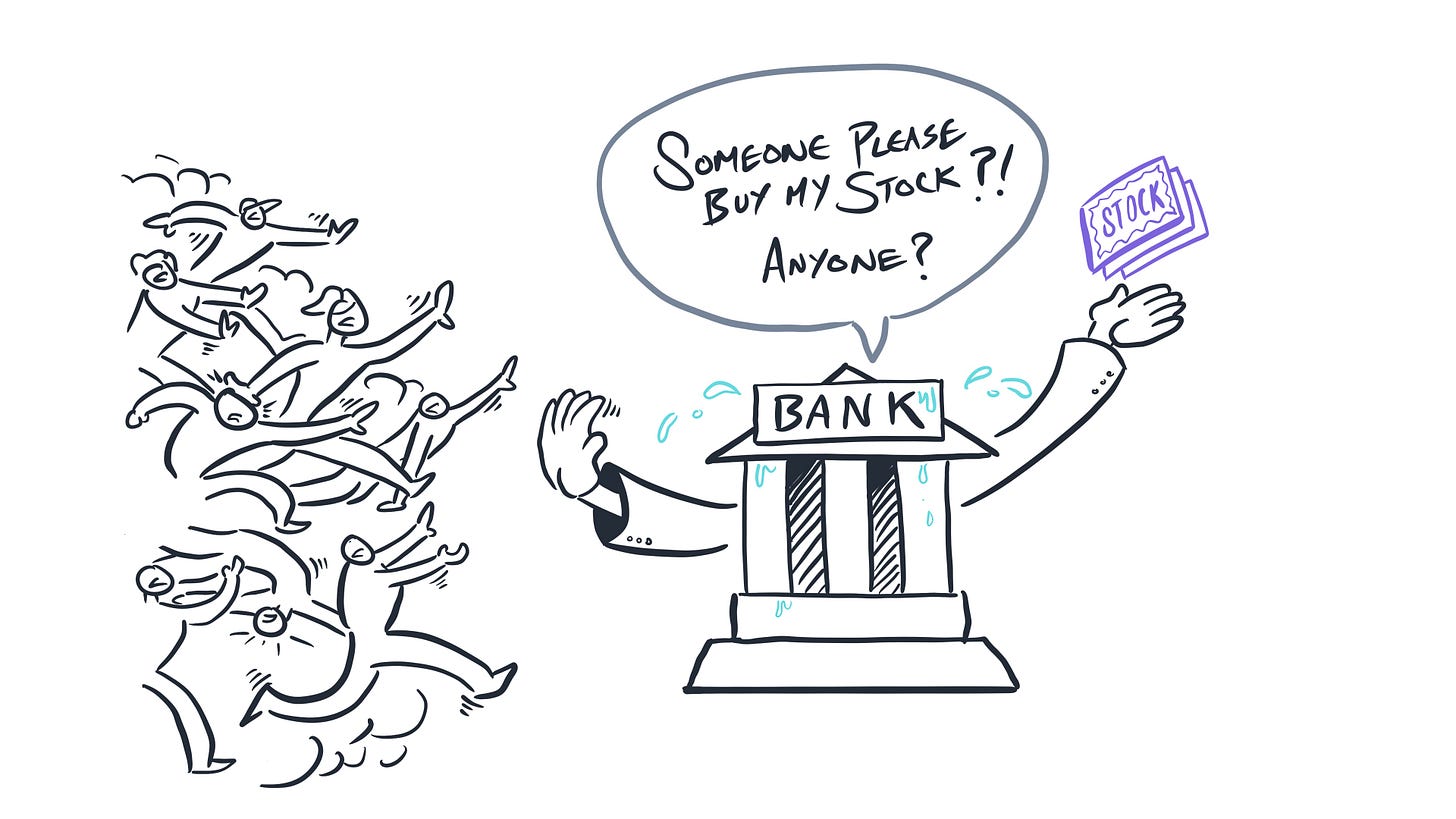

And at this point no one wants to buy the bank’s stock — much less newly issued shares — since there are no assets in the bank and it still owes money.

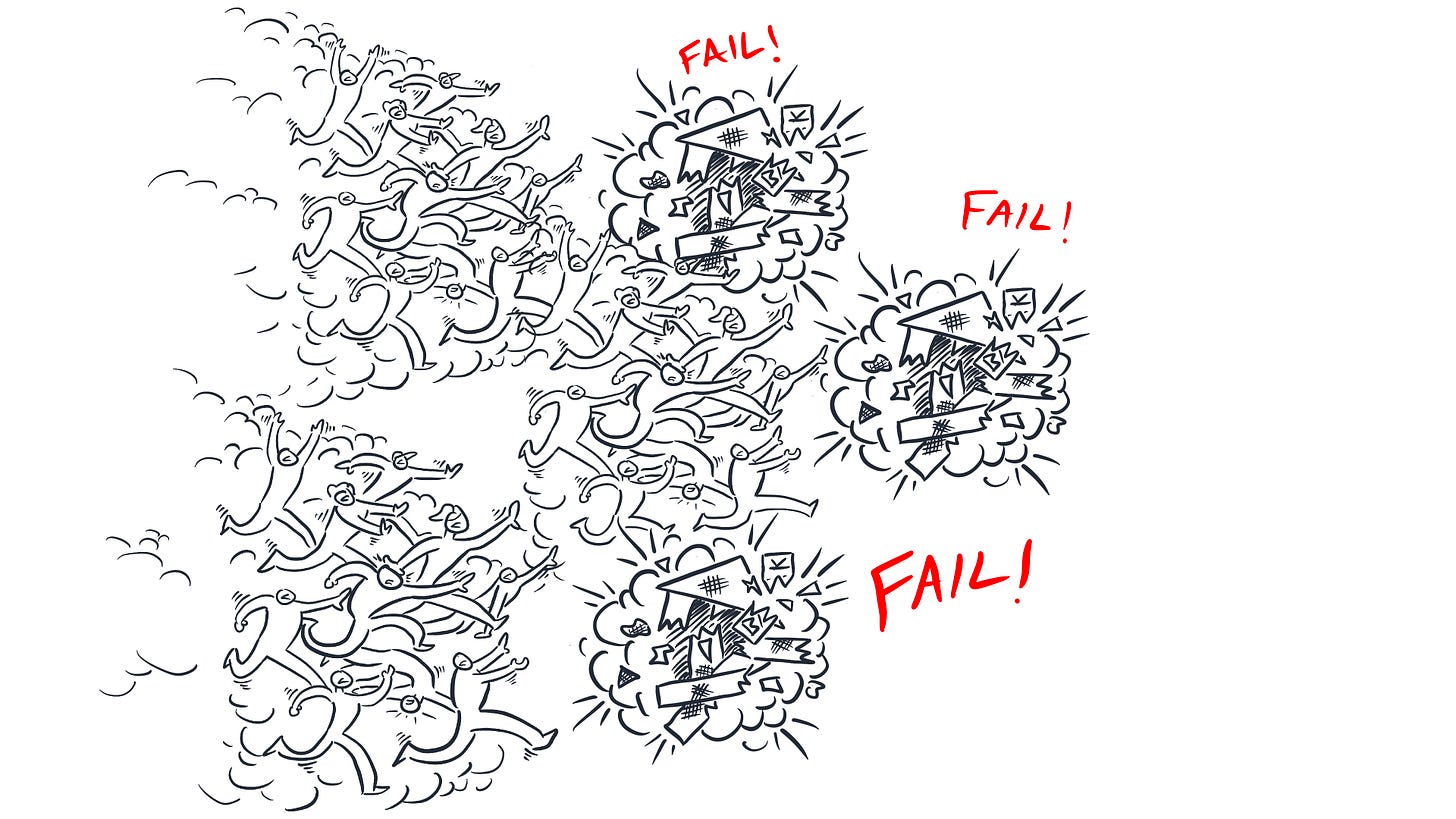

In the old days, that would be it. People would lose money. The bank would close. People with money at other banks would get nervous and start withdrawing their money — even if the other banks were solvent and had plenty more assets than liabilities.

This could cause a bank panic.

As people withdraw money from many banks at the same time, the banks run out of their cash buffers, so they try to sell assets, borrow money or raise capital — but since the other banks are trying to do the same, they can’t.

This is called a lack of liquidity, meaning that even though banks have valuable assets, if they can’t be sold and converted into usable, flowing, “liquid” cash, they are essentially frozen, or illiquid.

This forces banks to desperately try to sell their assets at a discount.

This lowers the value of assets.

As asset values fall, more banks become insolvent.

People fear they won’t be able to get cash anywhere and it leads to more bank runs and more bank failures.

This can get so bad that it can cause the entire banking system to fail. This is what happened during the Great Depression.

Thankfully, out of that disaster came new rules and ideas to prevent bank panics. Most notably, the Federal Deposit Insurance Corporation, or FDIC, was created to insure people’s deposits at banks. So, even if the bank failed, the federal government will pay you back your money, up to $250,000 today.

And, the Federal Reserve Act, which established the U.S.’s central bank, called The Federal Reserve, as the lender of last resort. This means the central bank will lend money to solvent banks even when no one else will.

These, and other regulations, are designed to increase the stability of the U.S. banking system and reduce bank panics. Most other countries have similar arrangements.

Today, bank failures are relatively rare compared to other types of businesses.

OK! So, what happened to SVB?

What happened to SVB?

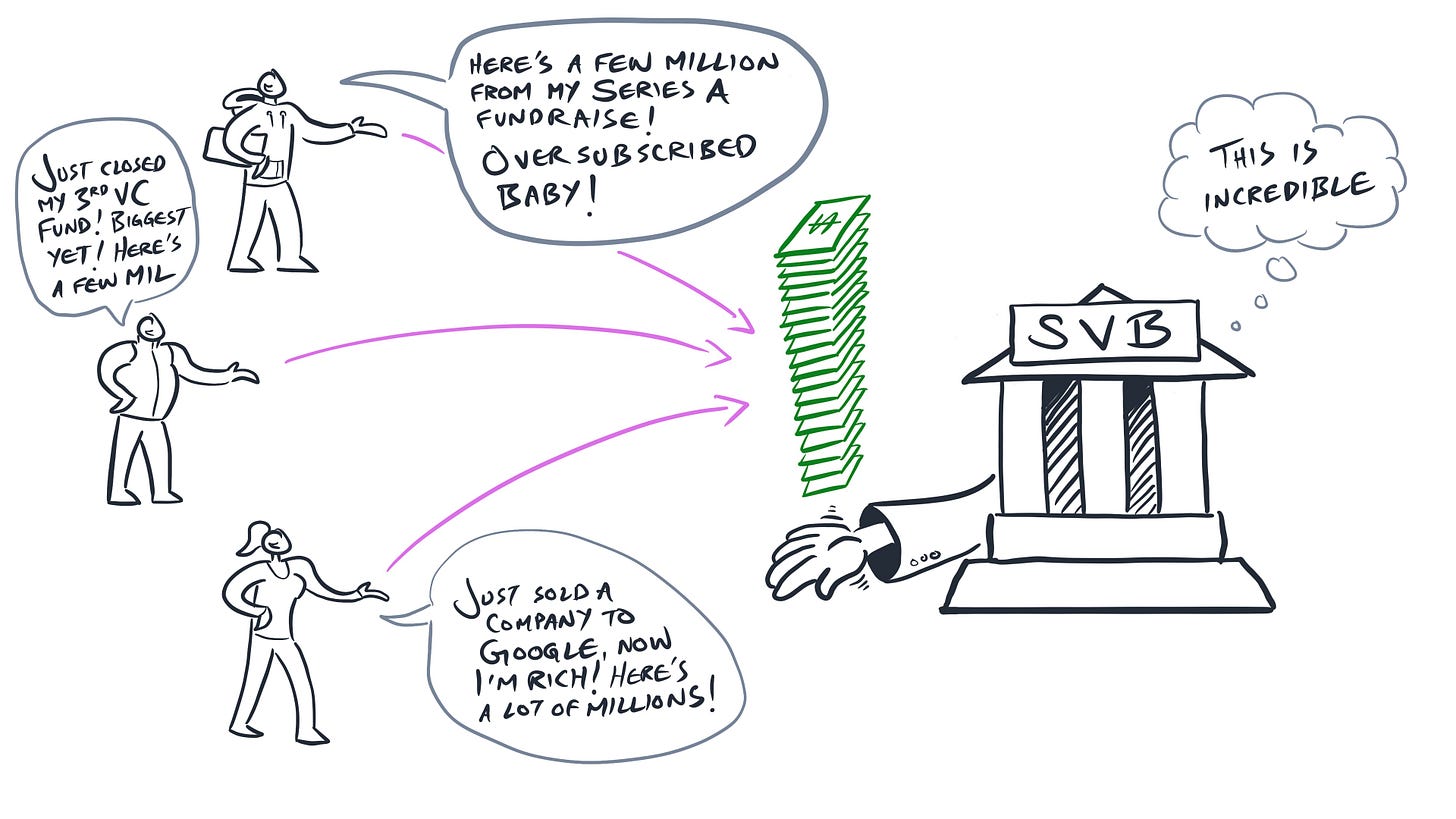

In a nutshell, SVB attracted a lot of technology startup companies and venture capital investment firms to deposit lots of money with them.

SVB used that money to make loans and investments, many of which turned out to be too risky.

Meanwhile, the tech investment bubble burst and government stimulus programs created for the pandemic came to an end.

SVB’s customers started withdrawing a lot more money than they were depositing.

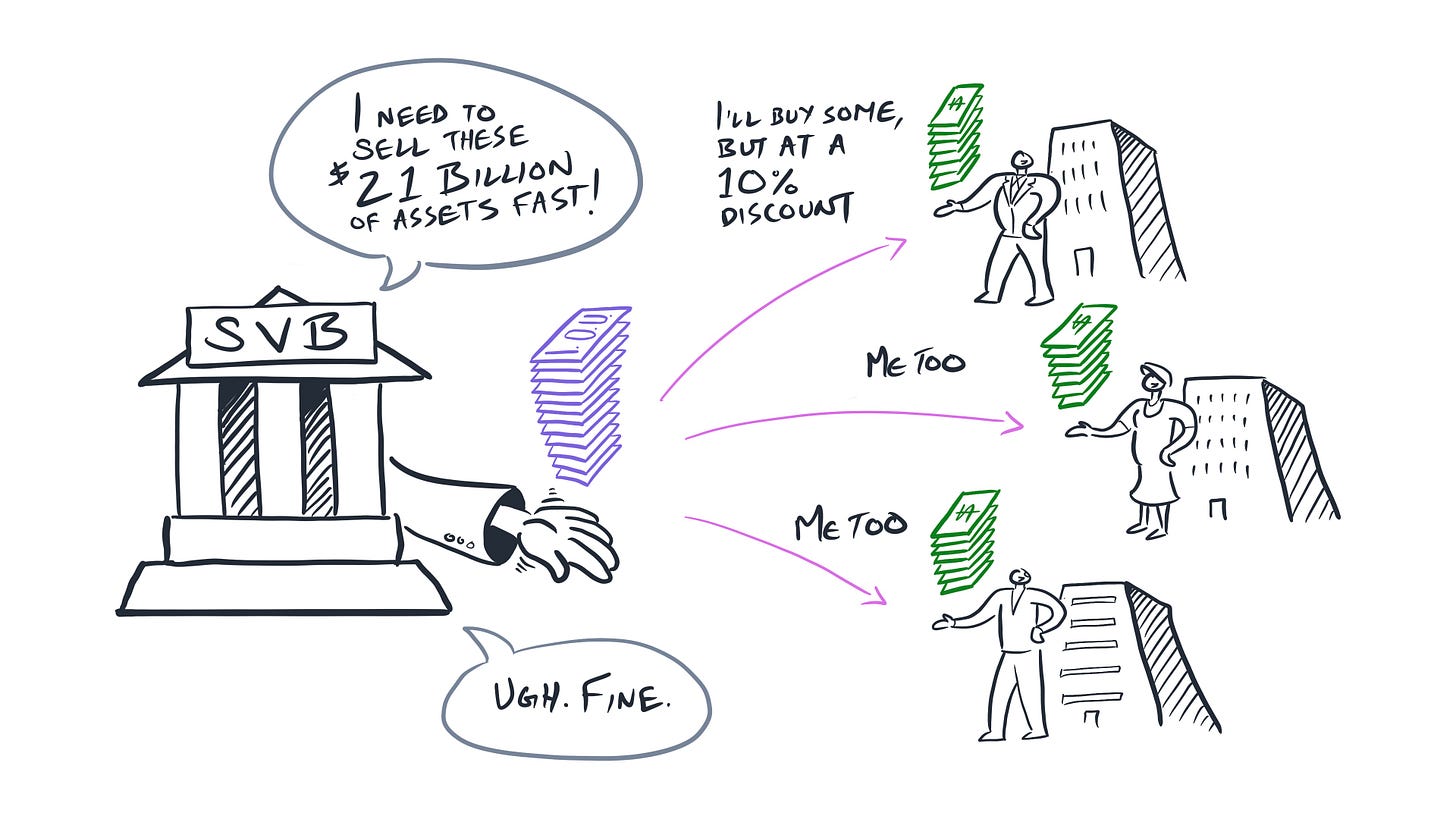

When it looked like they were running out of their cash buffer and heading for insolvency, they went to sell assets.

And here’s the rub: SVB bought most of their assets when interest rates were low, say around 2%. They weren’t making a ton of money from them, but it was still more than what they paid customers for their deposits, so they came out with a little profit. Everything would have been fine if they just held on to these low interest rate loans and investments until they were repaid.

But, they needed the money right now. And, things had changed. Interest rates had gone up. You could go make a new loan or investment and get something like 4% or more.

So, the only way someone would buy SVB’s old 2% asset instead of a new 4% asset would be if SVB sold it at a big discount.

Which SVB did.

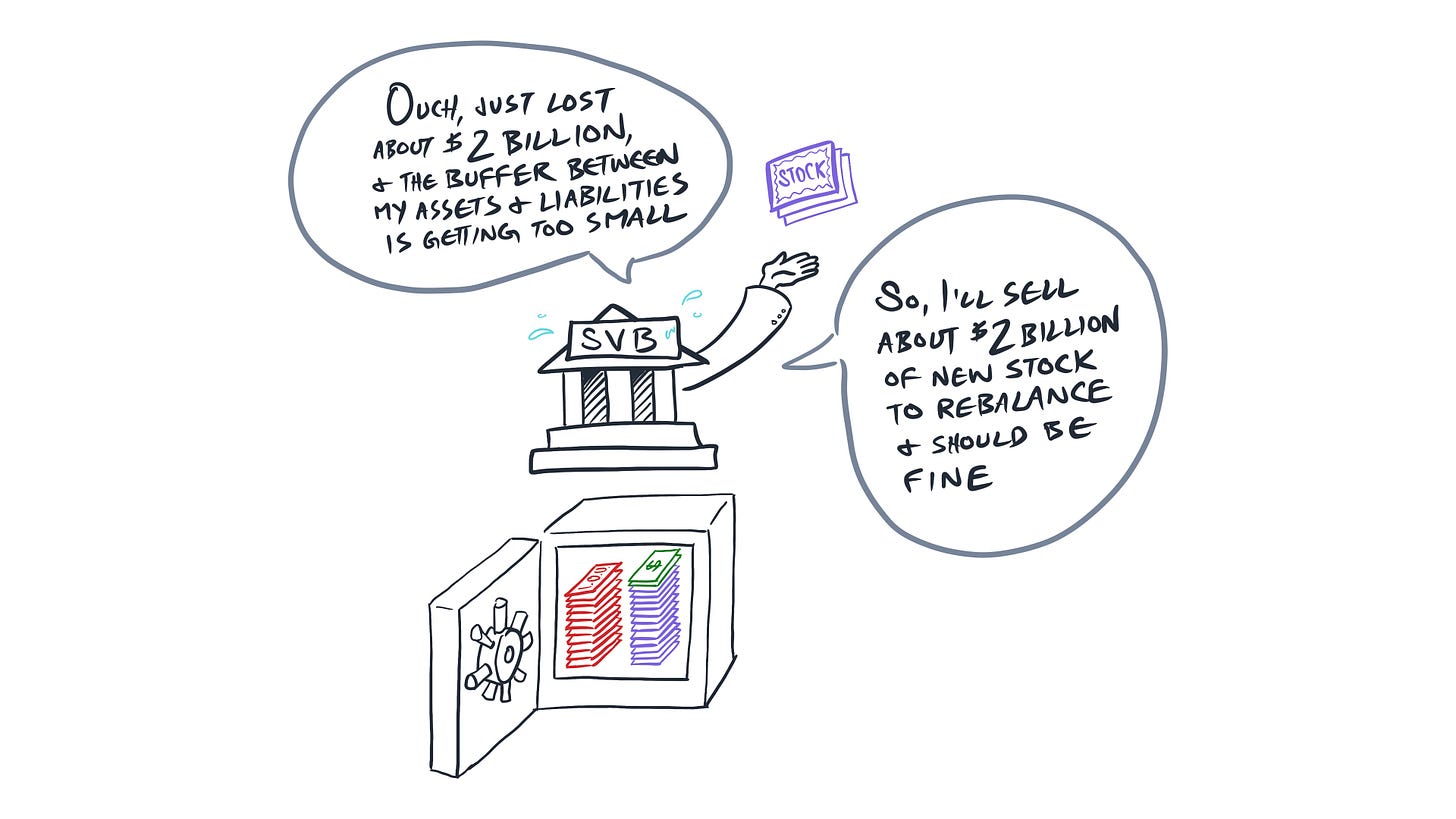

To make up for the loss, they were going to raise capital by selling new stock.

However, before they could, their customers started talking, got scared, and lost confidence in SVB.

And they started a run on the bank.

SVB was going to borrow the money they needed to meet their customers' withdrawal requests from the Federal Reserve — the lender of last resort. They would use their assets as collateral, which would still be worth their full value if held until they were repaid, which the Federal Reserve could do.

But, they couldn’t do it fast enough.

They ran out of money, and the FDIC shut them down and took it over.

Only a small portion of the remaining customers' deposits were insured under the $250,000 limit per account, and people started to panic that they would lose a lot of money.

The FDIC decided to make an exception and insure ALL the customer deposits to prevent a possible bank panic.

The FDIC then sold SVB and some of its assets and liabilities to another bank, First Citizens Bank, at a discount. The FDIC is keeping a majority of the assets and liabilities and absorbing the loss.

And that brings us to today.

OK, so that was what happened in a nutshell. But, as you can imagine there is a lot more going on, like:

Why SVB came into so much money

How their investments were risky

What extraordinary moves the U.S. Government made

What’s happening to other banks

What this all means for your future

We’ll get into these next in part 3!

What kind of banks are always liquid?

River banks.

😆